Investing in social housing is gaining traction due to its stable long-term income and above average yield.

“Social rentals provide long term, secure income to local and overseas investors.”

One of the core values of my business school, INSEAD, is to champion business as a force for good. This is a value we share at One Global Private Office and something I am advocating for the business at large and for our stakeholders alike.

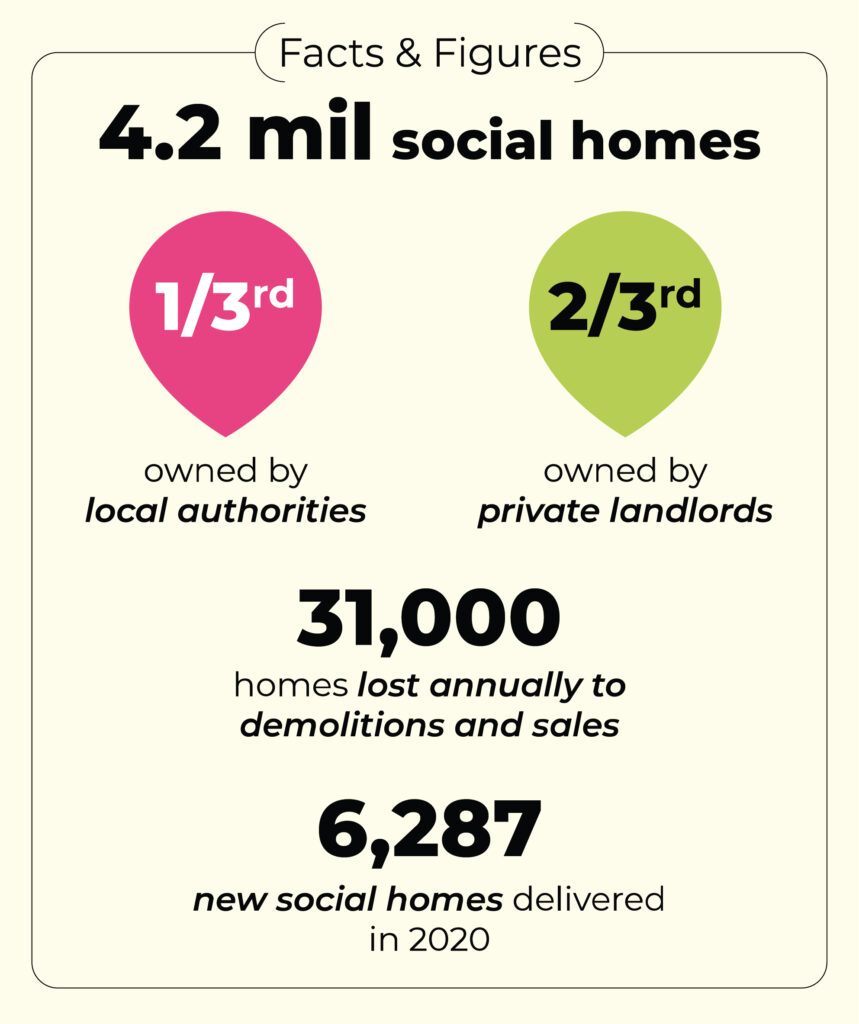

A recent initiative we took is to focus on the social housing market in the UK. A report from Shelter’s Commission on the future of social housing published in January 2019 recommended that a total of 3.1 million more social homes be built over a 20-year period or 155,000 new homes per year.

The need for an increased supply of social housing is demonstrated by large housing waiting lists, unafforda bility in the private rented sector, high levels of homelessness, and overcrowding. The National Housing Federation (NHF) and Crisis hence called for a much greater number, aiming for 340,000 new homes each year up to 2031.

The situation is dire and needs addressing. This is the reason we are initiating significant outreach and engagement with stakeholders in the private sector in the UK and internationally to tackle the issue.

Above average yield

Supported by specialist partners in the UK, and working hand in hand with housing associations and charities, we are building portfolios of properties sourced in the secondary market in areas with the most pressing social housing needs, refurbishing them and putting them in the social rent market. These portfolios, once vetted and approved by housing associations and charities, offer not only a much-needed addition to the pipeline of social housing so critically needed in the UK, but also long term, secure income to investors in the country and overseas. Furthermore, they benefit from vacancy protection, ensuring full income throughout the tenancy and providing our portfolios a positive yield well above industry averages.

As a countercyclical asset class subject to regulated (government set) social and affordable rents, rather than being driven by market forces, they tend to demonstrate lower correlation to short-term economic conditions than rents in other segments of the market. Finally, according to the DWP Family Resources Survey, 80% of social-rented tenants stay for at least 3 years in the same unit, while 44% of tenants remain in the same unit for over 10 years compared with just 10% of tenants in the private-rented sector.

Sought-after portfolios

These portfolios at scale are bought at the institutional level and are becoming highly sought-after assets within the capital markets as they address both their longterm financial objectives and their Corporate Social Responsibility goals. Such impact investments into social housing have risen from£ 1.5 billion in 2006 to just over £ 10 billion in 2020 and continue to grow.

Tailoring our approach to the specific objectives of our clients, we are bringing in much needed capital into this market, notably from Asia, and gaining increased traction amongst astute private investors, family offices, privateended funds, pension and sovereign funds, that recognise the growing need to integrate an ESG framework to help guide their investment choices.

Our objectives are to contribute to sustainability by tackling the systemic under-supply of social housing, and generating impactful, long-term, financial returns for our clients, while sharing our values of giving back to communities in need.

The next stage of our initiative will be to add scale by participating in the development of new build pipelines of affordable and social housing that we aim to deliver at the highest energy efficiency and sustainability standards. APR