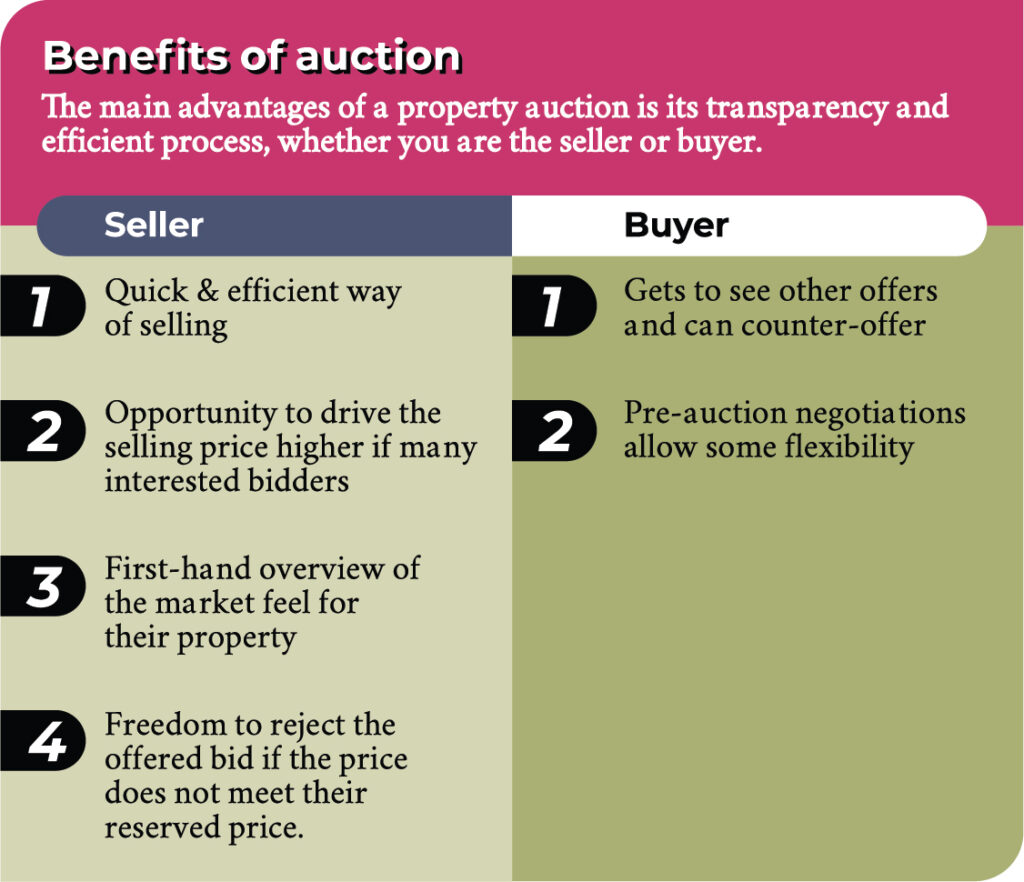

Auction are an alternative and viable method of selling your property other than private treaty or closed tenders.

In the past, whenever people heard of the word ‘auction’, the first thought that came to mind would be distressed sales. The seller must be in debt, and that’s why they needed to put up their property for auction. There is also the mindset tha t these properties are being repossessed by the banks, and it’s possible to get a “fire sale” price through the auction. In fact, these are all misconceptions, partly but not always true.

Chief Commercial Officer (CCO) of One Global Commercial

Business, Singapore

Alternative Method

Did you know that property auctions have always been an alternative method that you can use to sell your property other than via private treaty, closed tender, etc? Perhaps most of us have some ideas about it, but have you tried attending a physical auction before? Before we move on to the process of property auctions, let us take a look at the various types of sellers that have been putting up properties for auction.

1.Individual and Corporate property owners

In recent years, many property owners, both individuals and companies, have been using auction as a method of sale for their properties. An auction provides them “One will better understand the prevailing market conditions and have a better gauge of the buying interest and buyer’s limits by attending an auction.” with the opportunity to garner optimal pricing for their units, without having to compromise their asking price.

2.Banks and financial institutions

Property owners who have defaulted on their monthly mortgage loan with either banks or financial institutions will have their property foreclosed by these lenders who will then auction off their property under the classification of a bank sale.

The Procedure

Property auctions are held by various consultancy firms and local real estate agencies on a monthly basis. An auction list will be uploaded online via their respective websites a couple of weeks before the commencement of the auction and interested buyers can then register with the respective firms in advance to attend the event. Prior to the actual auction date, there are some procedures that you can follow:

1.For interested buyers, arrangements can be made to allow them to assess the property and its condition before bidding on them during the auction;

2.Once the final bid has been accepted by the seller after confirming the final price, the fall of the hammer by the auctioneer signals the successful sale of the property.

Do note that not all properties are sold during an auction. Sellers have the right to reject the bid offer if it does not meet the minimum reserve price or there could be no interested bids during the event. In this case, the property will be withdrawn from the auction. However, interested buyers are still able to make enquiries on these properties and negotiate to purchase them at a favourable price via private treaty.

Do note also the following:

1.The seller’s lawyer will draft the Sale & Purchase Agreement (SPA) aka Condition of sales;

2.The SP A must be ready before the auction commencement day, and terms & conditions will be determined by the seller;

3.The successful bidder will have to exercise their offer to purchase the property they won on that days;

4.The conditions in the agreement can not be negotiated on the auction day, but the bidder could request to view the agreement and negotiate any amendments to the SPA prior to the auction day;

5.As all properties are unique(property type, seller requirements, type of sale), hence each sale applies different conditions in the SPA;

6.The key elements in the agreement are deposit of 5%/10%, completion date, possession status, GST if any.

Attending an auction

Above all else that has been mentioned, attending a property auction can be an eye opener for some. Depending on how attractive the property is, the bidding process can be rather competitive. One will better understand the prevailing market conditions and have a better gauge of the buying interest and buyer’s limits by attending an auction. Everyone should always do their own research to keep abreast of the property news and trends before buying property or attending auctions. APR