A proposed 5-year freeze on rentals to take effect from 18 June has the city on edge as the local authority braces for a court challenge and a plunge in investments from locals and foreigners.

Apreviously divided Berlin is now united against further rental increases after rents almost doubled over the past 10 years. About 80% of Berlin’s population are tenants with two major landlords. The city has the highest percentage of renters among all major cities in Germany. The country meanwhile has the highest proportion of renters among all European nations.

Due to its reputation as a bohemian and groovy city, Berlin attracts both businesses and artists, causing a massive influx of migrants from other parts of the country and EU. In the last 10 years, an annual average of 40,000 people make Berlin their home. This is much more than what the city can cope with in terms of accommodation. As a result, landlords have raised rentals commensurate with the unrelenting demand.

The subsequent backlash has been severe. In April this year, a group of 50,000 people from all over Germany protested over the rental increases and called for expropriation or nationalisation of real estate from big landlords (companies that own more than 3,000 units).

The local authority came to a compromise solution – a 5-year freeze on rental and caps set for each neighbourhood instead of expropriation. Property owners who flout therules face a fine of up to 500,000 euros.

The two largest landlords, Deutsche Wohnen SE and Vonovia SE breathed a sigh of relief and said this was better than descending into London’s situation where ‘only the super rich can afford to live in downtown neighbourhoods’.

[ihc-hide-content ihc_mb_type="show" ihc_mb_who="1,2,3,4,5,9" ihc_mb_template="1"]In the aftermath, a legal challenge is expected to be mounted by the pro-landlord group while dire warnings have been made about plunging investments from investors.

The landlord group has called for alternative solutions, among them:

• Boosting construction by relaxing regulations, speeding up the approval process and reducing taxes on developers in order to increase supply. Berlin is notorious for taking up to 15 years’ time from concept to completion for an apartment block.

• Clamping down on Airbnb-type rentals to make supply available to permanent residents.

• Rewarding builders for constructing affordable properties instead of high- margin luxury apartments.

• Linking rental increases to incomes.

Achim Amann, Black Label Properties, says:

“It is a great pity that tenants and owners are again being pitted against each other. It particularly hits small landlords who rent out private dwellings. Nobody talks about these people. People looking for apartments in Berlin will find even fewer rental apartments on the free market that are subject to the rent index or rent cap.

Many investors from abroad and from Germany will now have less interest in buying rented apartments and apartment buildings in Berlin. Many investors will no longer want to invest in the Berlin housing market. Investors should now increasingly look around the Speckgürtel (literally: fat belt) encircling Berlin, and Brandenburg.”

Amann notes that there are already in existence rental restrictions under the German Civil Code (BGB) where rents above the rent index for existing old contracts in existing apartments cannot be increased. In particular, tenants whose rents are below the rent index are protected.

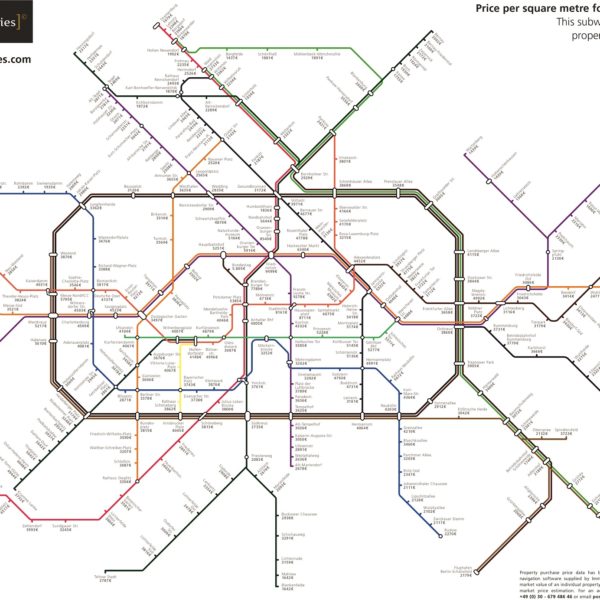

Further, Amann insists that the rent index does not reflect the actual market rents. “Please see our current Rental Map here.”

Black Label Properties, a Berlin-based real estate agency has based its findings from the 2019 Price Map and Rental Map obtained from the software ‘MarktNavigator’ from Immobilienscout24.de, which helps to predict trends and prices.

PAST TRENDS

Prior to the announcement on 18th June, Berlin’s apartment sale prices and rentals have charted an upward trend thanks to a combination of shortage of vacant renovated units, politics and rental price restrictions. Up to then, purchase prices continue to rise by 10-15% rather than the 5-8% as expected. The purchase price for new builds has charted new highs, while the Rental Price Map 2019 shows a similar upward trend with rents within the S-Bahn belt continuing to rise. But, there were then already many signs that things would come to a boil; increasing numbers of young families were leaving Berlin for the outskirts to take advantage of cheaper rentals. More good developers and construction companies which have supplied affordable apartments in the past were also turning away from Berlin and choosing to build elsewhere

Up to then, purchase prices continue to rise by 10-15% rather than the 5-8% as expected. The purchase price for new builds has charted new highs, while the Rental Price Map 2019 shows a similar upward trend with rents within the S-Bahn belt continuing to rise.

But, there were then already many signs that things would come to a boil; increasing numbers of young families were leaving Berlin for the outskirts to take advantage of cheaper rentals. More good developers and construction companies which have supplied affordable apartments in the past were also turning away from Berlin and choosing to build elsewhere.

[/ihc-hide-content]